Our recommendations for One Seattle’s Comprehensive Plan

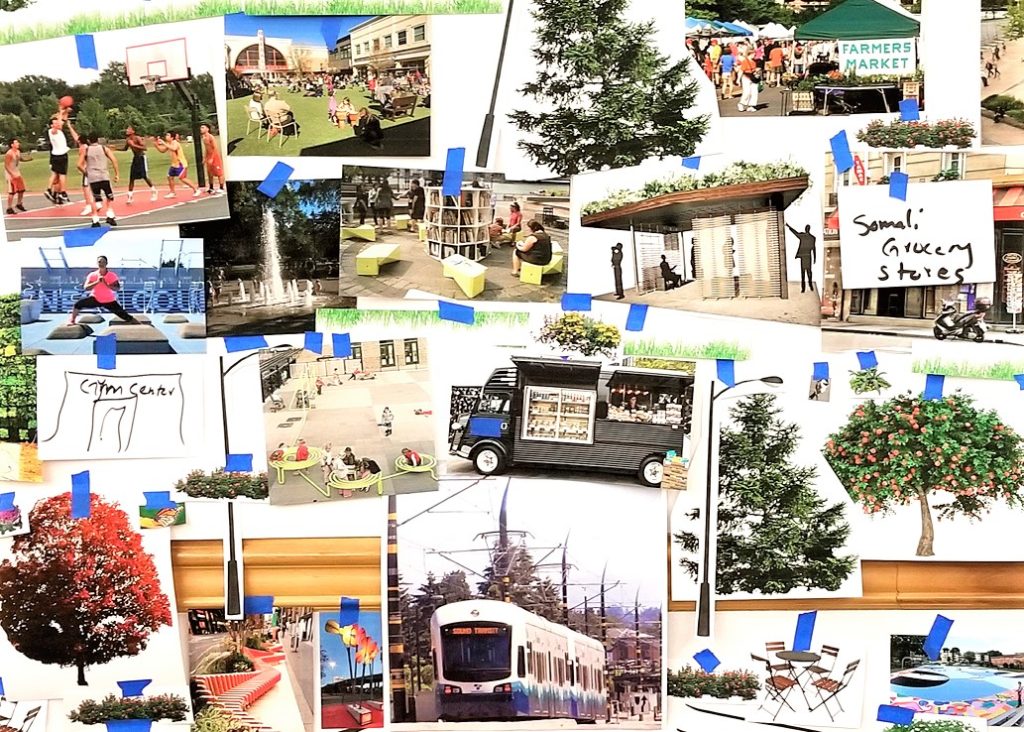

Puget Sound Sage, along with dozens of BIPOC-led community organizations across the city and county, have developed a long-term vision for our communities to thrive in place, which we call Community Stewardship of Land (CSL). Within a CSL framework, Black, Indigenous, and People of Color communities permanently own or control land for long-term, collective self-determination primarily through land trusts, cooperatives, and other non-profit models.

We believe CSL is the only antidote to unending cycles of displacement for BIPOC communities. Only with our homes and neighborhoods protected from real estate speculation can we withstand the global forces that have dispossessed our communities’ homes for hundreds of years. The more land we take off the real estate market and into collective ownership, the more stable our communities will be, now and far into the future.

For Racial Justice, Seattle’s Comprehensive Plan should center Community Stewardship of Land

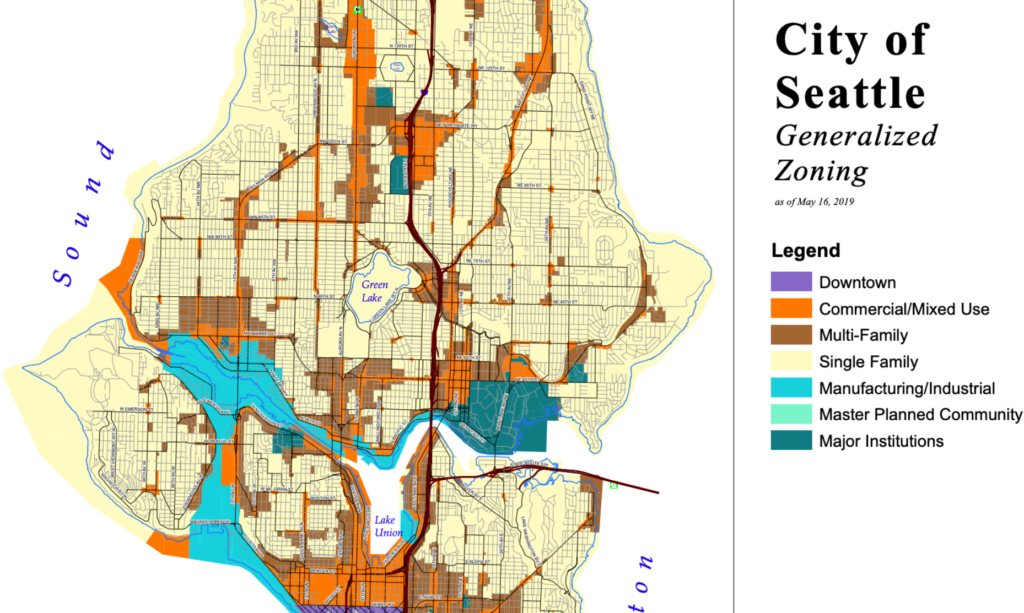

The City of Seattle has the power to create meaningful regulations through its Comprehensive Plan, like zoning, labor standards and environmental protection, for the health and welfare of its residents.

We believe that the Comprehensive Plan can and should help even the playing field between community-driven public development and land speculation. The plan should prioritize policy that centers BIPOC communities and public or non-profit developers as the preferred entities to control and develop land for community-driven projects, especially in areas at high risk of development.

Lifting single family zoning is not the magic bullet some may imagine

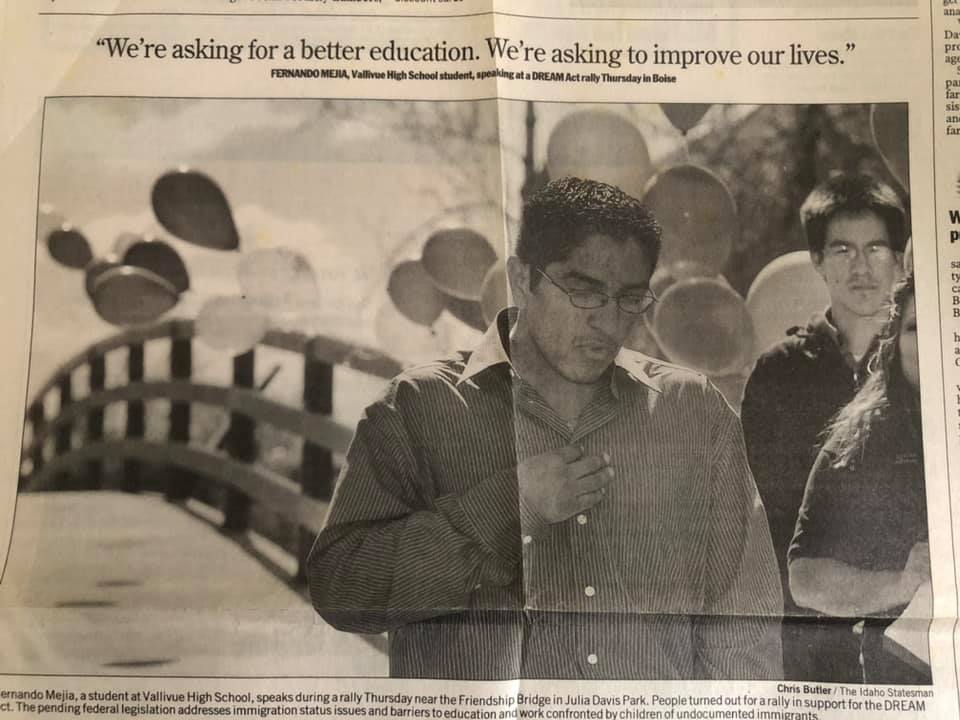

Reimagining single-family neighborhoods unveils deep-seated property and homeownership interests like nothing else. Public debate so far in Seattle shows a willingness by many to upzone, driven in part by a desire to undo racial segregation, but the Comprehensive Plan must dive deeper into racial equity outcomes to find a more comprehensive solution.

The case has been well made by many others to get rid of single-family zoning, such as: 1) we need more land to accommodate the people who are already here or will move here in the next 25 years; 2) we must increase density to take advantage of Seattle’s transit rich urban corridors and nodes to fight climate change; and 3) single family zoning was a tool of systemic racism, resulting in segregation and multi-generational loss of wealth for BIPOC people, and must be rejected.

But will lifting single family zoning really accomplish these things? To address number one, we need to upzone significantly. Looking at the experience of Minneapolis, it is unclear that single family property owners will rush to sell or convert their homes for triplexes and townhomes, even in a hot real estate market. Number two: to take advantage of Seattle’s rich transit service (relative to the suburbs), we need all the new people moving here with high incomes to give up their cars (or at least greatly reduce their use) – but it is unclear that is happening either. And finally, to repair the harm done to BIPOC communities over the last 100 years, it is unclear that a wave of new construction in single family zone areas will increase affordability or accrue benefits to BIPOC households.

Relaxing single-family zoning is not the cure-all and, by itself, may actually exacerbate existing racial inequity and disparity. We acknowledge and agree that racialized zoning got us into this mess, and that single-family zoning continues to be a problem, but getting rid of it alone does not undo the damage:

- In no way does it restore the loss of multi-generational wealth to BIPOC communities specifically named in racial covenants.

- In no way does it guarantee a right to return to all the families and households pushed out over the last 30 years.

- In no way does it guarantee future BIPOC households the opportunity to move into these newly re-zoned areas.

- Finally, unless done with explicit centering of their needs, it may not even give BIPOC communities a shot at creating generational community and family wealth in the future.

How to get zoning for racial justice right

We join many other organizations calling for a more racially and economically just future for Seattle. Our contribution is to call for non-market driven development outcomes at a significant scale, e.g., that up to 1/3 of land in high displacement risk areas be owned and stewarded by non-profit or public entities.

To assess this potential, we suggest the following actions:

1. City planners should model potential location outcomes for low-income households, BIPOC communities, immigrants and refugees, queer people, and disabled persons, (all of whom currently face barriers in the real estate market and are at risk of displacement) for each of the alternatives.

It is not enough to project that more housing supply will automatically increase equity. The City must estimate who will live where after the changes to zoning, who will economically reap the rewards, and who is most likely to be displaced. We urge the City to find sophisticated consultants and analysts who know how to develop models that drill down to race, ethnicity, gender, and ability. This data will be critical to making an informed choice.

2. In all analyses of the alternatives, the City should assess what large-scale, community-led development and land ownership would mean for racial equity and environmental benefits.

There is evidence that higher density options will create more available land for development and that could include Community Stewardship of Land. But what happens when we assume stable, low-income BIPOC neighborhoods in both high-risk and low-risk displacement areas, based on widespread community stewardship of land? How would community stewardship of land help public transit use? How does it impact open space, resiliency, and sustainability?

3. The City should assess the impact of preserving all older multi-family buildings and the contribution that it would make to climate resilience, affordability, and racial equity.

The assessment should apply across all alternatives the City chooses to study. Preserving older buildings is the most effective strategy to stabilize communities in the face of gentrification and redevelopment, both residential and commercial. Again, this kind of analysis reduces the wishful thinking that increasing building envelopes creates opportunity for all – instead, it allows us to imagine what equity would look like and provide opportunity for real comparison.

photo by KUOW – Where should Seattle build homes for newcomers?