Seattle’s Minimum Wage Kicks in April 1st 2015

With Seattle’s new minimum wage kicking in just two days, and tons of speculation about the impacts, I’d like to break down what it means for workers, businesses and our economy in some hard numbers.

What does Seattle’s minimum wage mean for workers?

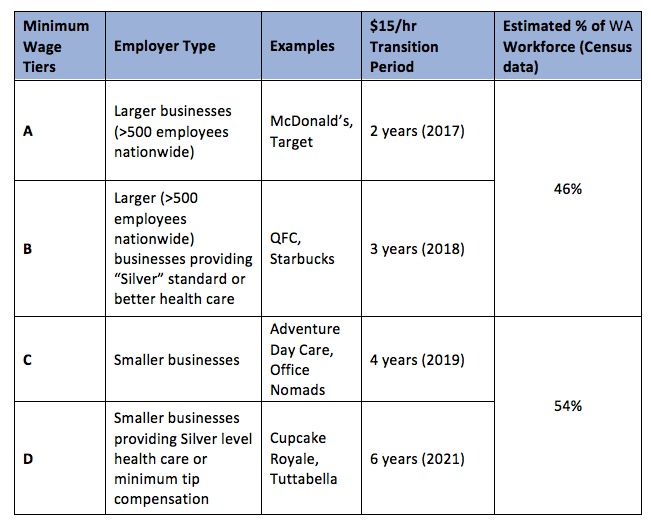

Everyone in Seattle should be earning at least $11 per hour starting on April 1st. Depending on the type of business you work for, the compensation package may look different. If you work for a large employer (500+ employees) like Target, McDonalds or Amazon, your paycheck should reflect an hourly wage of $11 per hour. If you earn minimum wage ($9.47) today, then in two days you should earn $1.53 per hour more before taxes. If you work 32 hours a week and are paid every two weeks, your paycheck should show an increase of $91 before taxes. By December 31st 2015 you should have earned $1,836 more before taxes. That is enough money to buy a quality bed, put down a deposit on an apartment, or spend $10 on lunch three times a week for an entire year.

If you work for a smaller business (500 or less employees) your paycheck should reflect at least $10 in direct wages per hour, and $1 dollar in either tips or health care benefits. If you don’t get tips or healthcare benefits, you should be earning $11 per hour as your wage. So for example, if you are a tipped worker, your wages should reflect a $.53 cent increase AND your employer should show that you have earned least $1 in reported tips or they have contributed at least $1 per hour you worked towards a health care package. If you work 32 hours a week and are paid every two weeks, your paycheck should show an increase of at least $31 in pre-tax wages and at least $60 in compensation in the form of tips or healthcare benefits. By December 31st 2015 you should have earned $636 more before taxes.

What does Seattle’s minimum wage mean for the economy?

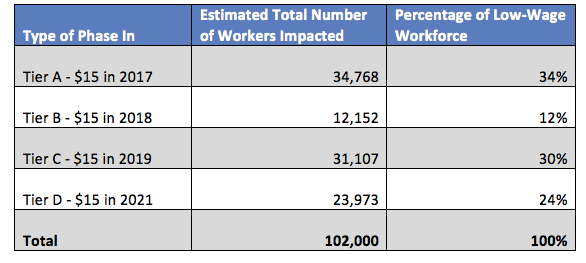

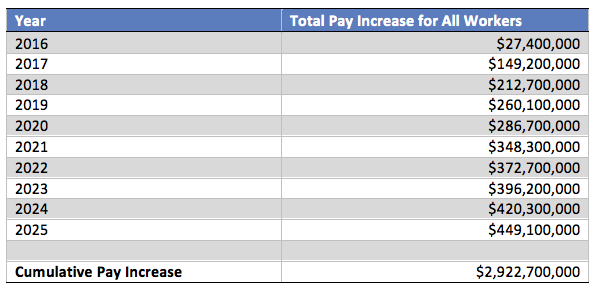

The University of Washington[i] estimates that nearly 37,900 people are currently earning minimum wage in the City of Seattle. As we’ve already estimated, each person will earn between $636 and $1,600 more this year if they work 32 hours per week until December 31st.[ii] If we look at the aggregate increase for all 37,900 workers earning minimum wage – minimum wage earners in Seattle could earn between $24 million and $69 million more in 2015 than they would have without a higher minimum wage. That represents a significant increase in buying power for Seattle’s lowest wages workers. That’s enough money to buy between 2.4 million and 6.9 million $10 lunches.

What does Seattle’s minimum wage mean for businesses?

Every business has a different model and labor costs can represent a different percentage of your total labor costs. The implications for restaurants have been dominant in the media, so we’ll explore what the implications are for a Seattle restaurant. Using the Washington Restaurant Association’s break estimates of a typical budget breakdown featured in the Seattle Magazine, we can get a sense of the total operating costs. According to Anthony Anton, CEO of the Washington Restaurant Association: 36% of funds are devoted to labor costs, 30% to food costs and 30% to everything else. These restaurants then operate on a 4% margin.[iii]

If we look at a $1 million dollar business, labor accounts for 360,000 of their total operating costs. Assuming all workers earn minimum wage (which means this estimate is looking at the largest possible increase to labor costs as the typical wage for cooks in our region is $11.27 per hour and the typical wage for dishwashers is $10.45 per hour)[iv] their labor costs should increase between 380,160 (if all workers are tipped) and 417,600 (if no workers are tipped). It’s safe to say that the total labor costs will be somewhere between those two numbers. Assuming 50% of work hours are tipped and 50% are non-tipped). The largest possible increase to labor costs for this business would be 398,880 – representing a 10.8% increase in labor costs. However, what is that increase compared to total operating costs? With a 10.8% increase in labor costs, total operating is no longer 1 million, but 1,038,880 – a 3.8% increase in total operating costs. A restaurateur could conceivably raise prices by 3.8% to make up the difference. For a $10 meal, that is a 38 cent increase. In short – in two days 38,000 people should see increases to their paychecks and some prices may marginally increase. By the end of the year – millions more dollars will have gone to the people who drive our economy – workers.